Earlier than discussing the superior buying and selling technique I’ll clarify on this article, it’s important to emphasise that the indicator this technique is predicated on differs significantly from the normal RSI indicator we all know. It’s completely different in each side, together with key ranges and rather more. Golden Scalping RSI indicator https://www.mql5.com/en/market/product/124308, which I launched totally free on the MQL5 market 20 days in the past, represents a real revolution on the earth of buying and selling. The phrase “breaking the secrets and techniques of RSI” talked about within the title refers to utterly new and progressive pivotal ranges, which have been found by means of thorough evaluation and testing. I discovered that these ranges work together with market value motion in a unprecedented and unprecedented method. These ranges both type help and resistance zones, peaks and troughs, or confirmed breakout traces to the upside or draw back.

I’ll current some pictures and actual chart examples to show how these ranges work together with chart motion in an astonishing and memorable method.

We’ve got the 30 stage, which is the median stage of the indicator. Above the 30 stage, we now have 5 ranges:

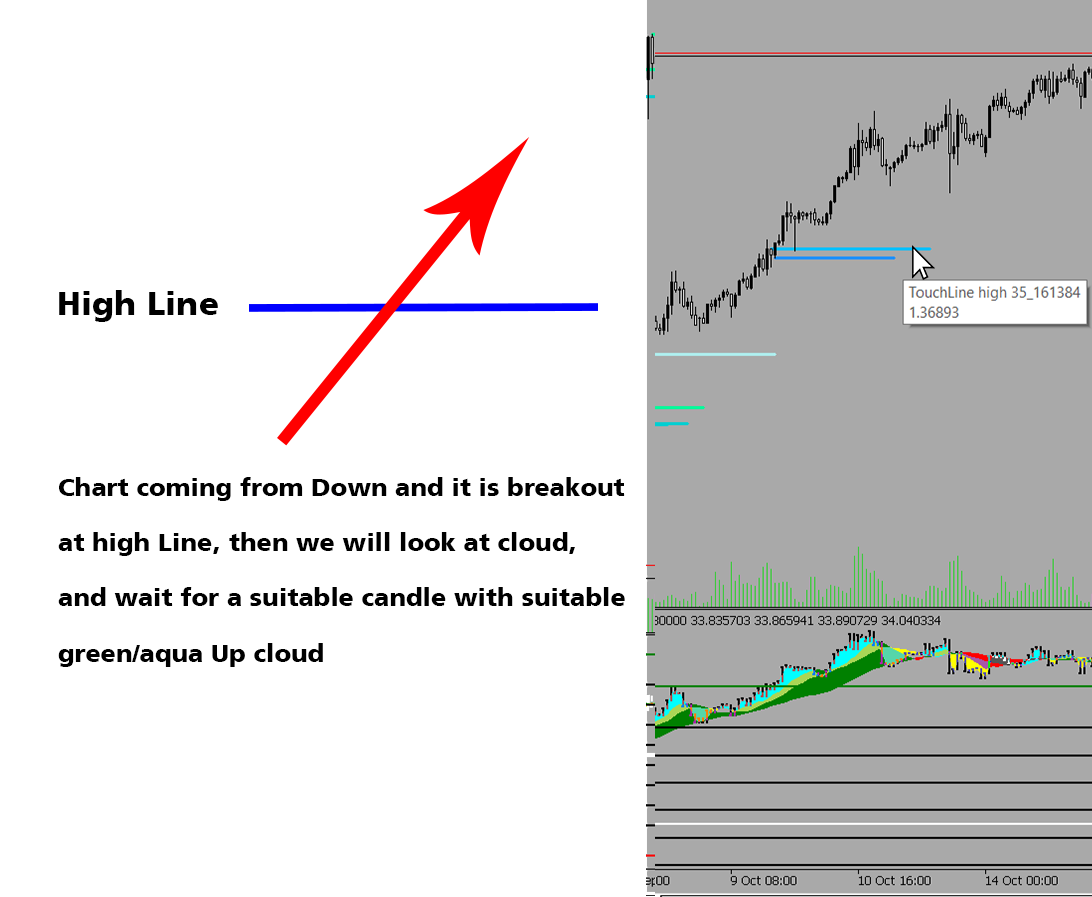

Every stage consists of a excessive line and a low line. As proven within the color-coded picture, each stage has two traces, which means we may have a “TouchLine excessive” or a “TouchLine low.” So, as an illustration:

Colour Coding:

For the degrees above 30, the low line is dark-colored, and the excessive line is light-colored. For ranges under 30, the excessive line is darkish, and the low line is gentle. General, the traces above 30 are shaded in blue and inexperienced tones, whereas the traces under 30 are shaded in crimson and yellow tones.

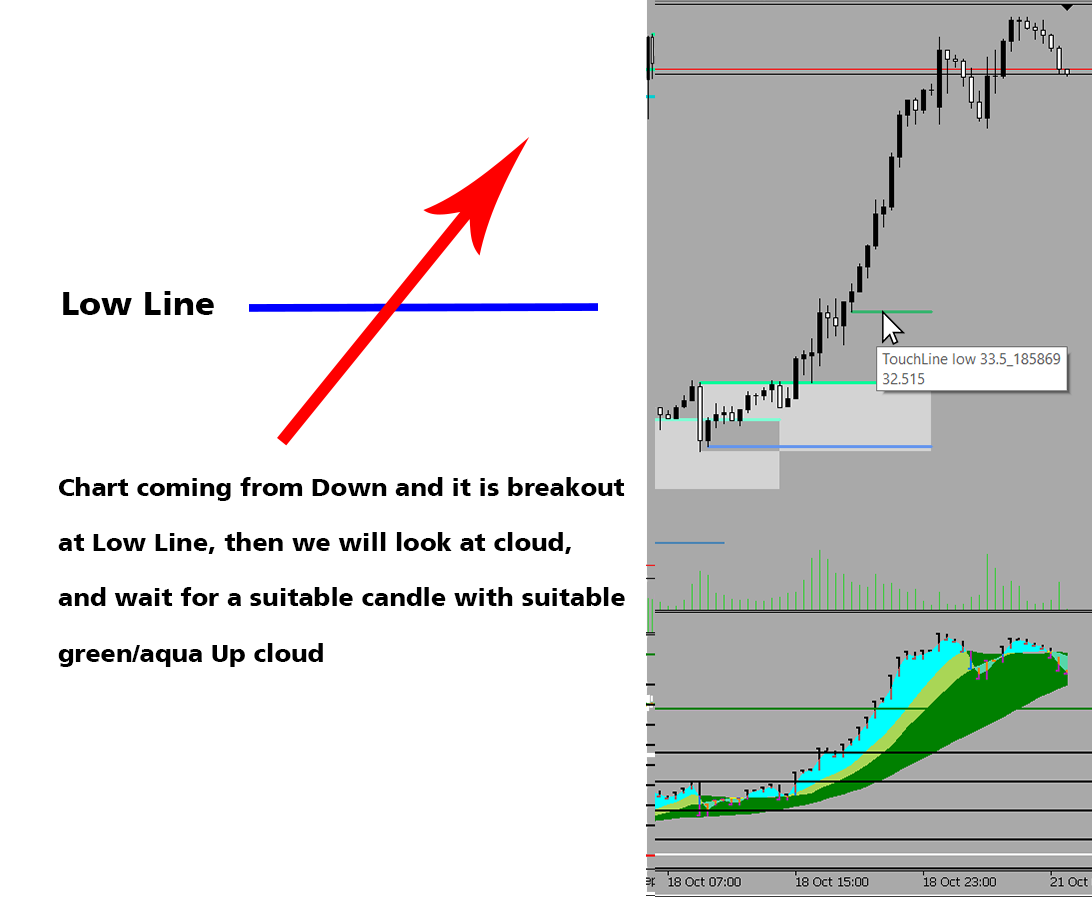

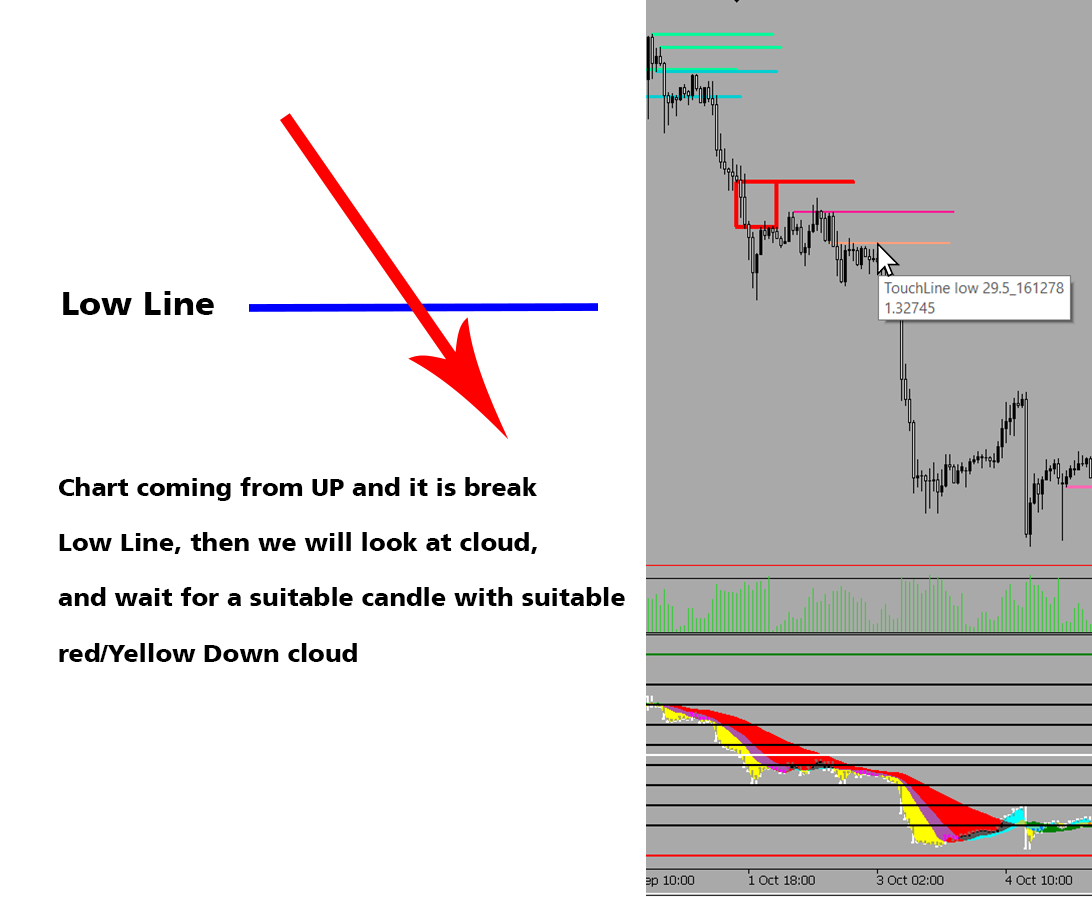

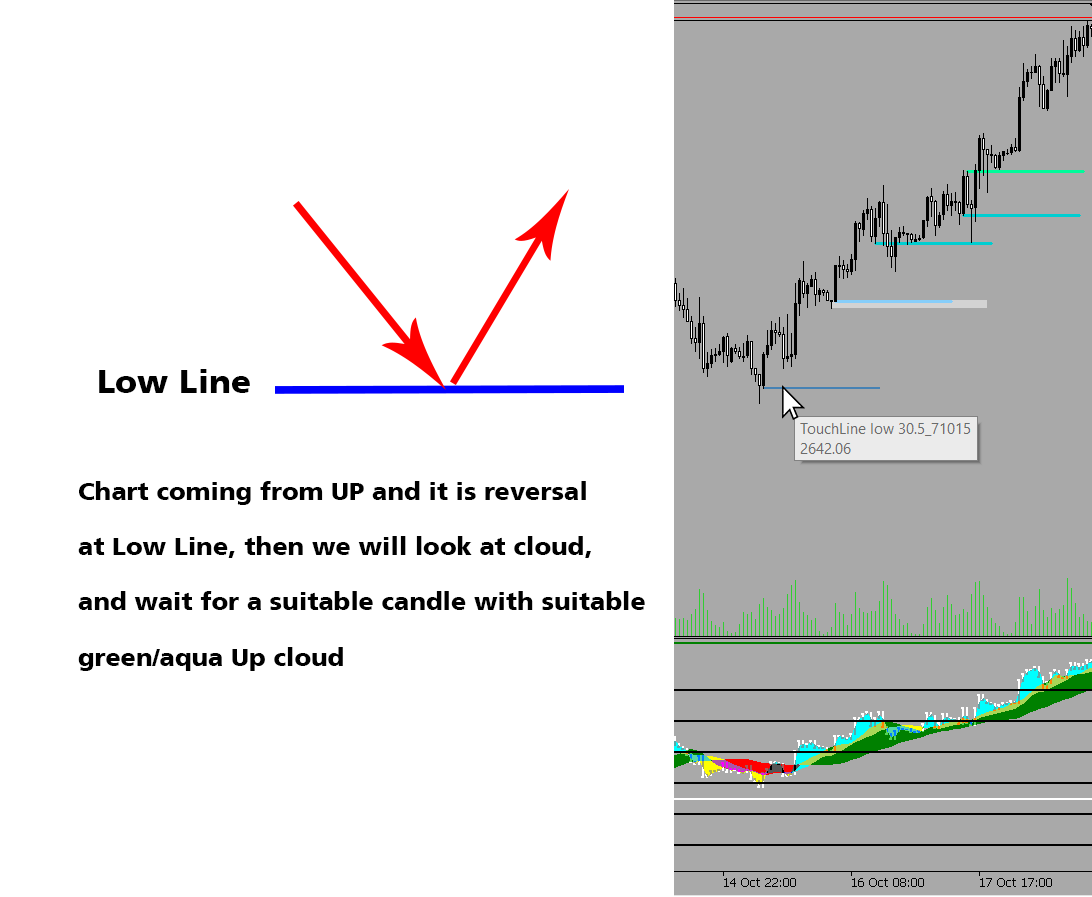

How the Strains Work:

There are two modes for forming the traces within the indicator’s choices:

Enhanced Affirmation Mode, which requires two candles to verify the looks of a line:

EnhancedConfirmation = true; // Verify traces with circumstances and shut two candles

Delicate Affirmation Mode, which is extra delicate and requires just one candle:

sensitiveConfirmation = false; // Verify traces with delicate mode and shut 1 candle

You may select both mode however not each concurrently, as too many traces on the chart can develop into overwhelming and trigger confusion.

Particular Zones:

Within the exams, I discovered two particular zones which will function launching factors for value rises or declines, or as accumulation zones. These two areas are highlighted with a gray-shaded field (LightGray).

Understanding the Line Names:

As seen within the pictures, hover your mouse over the road to know its title and whether or not it’s a excessive or low line. Additionally, you will see what kind of line preceded it—whether or not it was a excessive or low line. It’s worthwhile to pay shut consideration to the final and former traces. At all times hold your eyes on the cloud within the decrease a part of the display screen and the traces within the higher half. If you happen to resolve to open a place, select the suitable timing by choosing the correct candle, as this indicator makes use of candles, not traces. As an example, search for a reversal or engulfing candle together with the cloud shade.

Relating to the floating panel, you may disguise it from the settings, and it’s important and helpful to remind you concerning the matter of breaking the 30 stage both downwards or upwards.

As for the crimson and blue packing containers, they’re to verify the breakout of the 30 stage with ten candles.The 30 stage might witness a breakout downwards, then upwards, after which downwards once more, and the other may occur as effectively. It’s because it’s a important stage for figuring out the pattern, and the breakout may be sturdy with out returning to the 30 stage.

There’s a distinction between the blue and crimson packing containers and the 2 unusual 30 stage traces that seem as excessive and low traces.These two traces, if they seem, type a complicated breakout, however they don’t depend on the affirmation of 10 candles just like the crimson and blue packing containers do. As a substitute, they observe the identical modes that the remainder of the degrees use with one or two candles.

Notice: For instance, there could be a message that the pair is in a optimistic state based on the 30 stage, however in actuality, there’s a decline. Sure, the perform of the floating panel is to remind you that you’re nonetheless above the 30 stage, however this doesn’t imply that the value can’t drop. After all, you may simply distinguish the scenario, because the superior cloud will present you at the moment a crimson and yellow cloud. Moreover, the revolutionary stage traces will present you ways they’re being damaged from above to under, and this in itself (“the cloud + the best way the extent traces seem + how the excessive is damaged from above to under and the low from above to under, as proven within the picture examples”) might be a motivator to open promote trades. Nevertheless, as we mentioned, our eyes stay on the excessive and low traces and the cloud’s form. However while you resolve to open a commerce, it is advisable to be extra exact and cautious in selecting the suitable candles to enter.

Notice 2:Some traces might not seem despite the fact that the chart has damaged a stage, and the explanation for that is that displaying the road requires sure circumstances. Maybe the value motion and chart don’t align with the circumstances you’ve set for drawing the traces within the enhanced and delicate modes. Due to this fact, it’s not dangerous to keep watch over the chart and the important ranges within the decrease part of the display screen. There are examples the place the chart touches these ranges with out them showing on the primary chart, on account of a lacking situation, for instance.

Notice 3:I like to recommend the second indicator that I printed two weeks in the past https://www.mql5.com/en/market/product/124406, which is outstanding in each sense of the phrase and may have future updates. It is rather distinctive in its transitions and exact fluctuations, and it may help you in studying the scene.

Recommendation:Keep away from buying and selling throughout main information occasions.Keep away from buying and selling throughout main information occasions; there are dozens of buying and selling alternatives with completely different pairs and with glorious outcomes utilizing these revolutionary ranges and the cloud. Buying and selling throughout information occasions is just playing together with your cash, even when you escape a few times. We’re not right here to speak about any type of playing or recklessness. We at the moment are discussing scientific and mathematically found distinctive ranges with these traces and clouds. As I discussed earlier, these ranges and contours, and their distinctive alignment with value motion, are akin to breaking the secrets and techniques of the RSI. I’m nonetheless within the strategy of discovering different secrets and techniques for these ranges and others on this indicator.

Truthfully, earlier than I conclude, and regardless of my years of expertise in buying and selling, the method felt like I used to be coming into an unlimited ocean, with the ocean to my proper, the ocean to my left, in entrance of me, and behind me. Actually, once I have a look at the chart now, as proven within the pictures, at the least I do know the place I stand. I now perceive what’s behind me, why the chart went up or down, and I even have over 80% confidence in figuring out what’s forward of me. These revolutionary ranges and contours, together with the affirmation cloud, will utterly change your perspective.

I want you all success in your trades, and I welcome your friendship on my web page on this website, as I’d submit updates with essential explanations, and you may rapidly test them out.

There might be a second half to clarify some crucial secrets and techniques and options.Moreover, there might be important upcoming updates to the indicator, maybe involving the addition of latest ranges or facet pattern traces.