Merchants,

I sit up for sharing a few of my prime concepts for the week, together with my exact entry and exit targets.

Final week was tough for the markets, with solely the vitality sector closing within the inexperienced. We proceed to see a sample of decrease highs and decrease lows emergy in SPY, with $600 resistance remaining intact. So, within the quick time period, we’re experiencing a traditional correction, so it’s very important to be ultra-selective on the lengthy facet now, concentrating on relative energy for directional lengthy swings.

It’s necessary to bear in mind that in such a market pullback, the probability of breakouts working decreases. There’s additionally a cyclical shift that’s occurring with small-caps, with the typical change from open amongst gappers assembly particular standards falling unfavourable final week.

So, with warning and relative energy in thoughts, and never seeking to be aggressive on the lengthy facet till we’re above a flattening-to-rising 5-day SMA, right here’s what I’m .

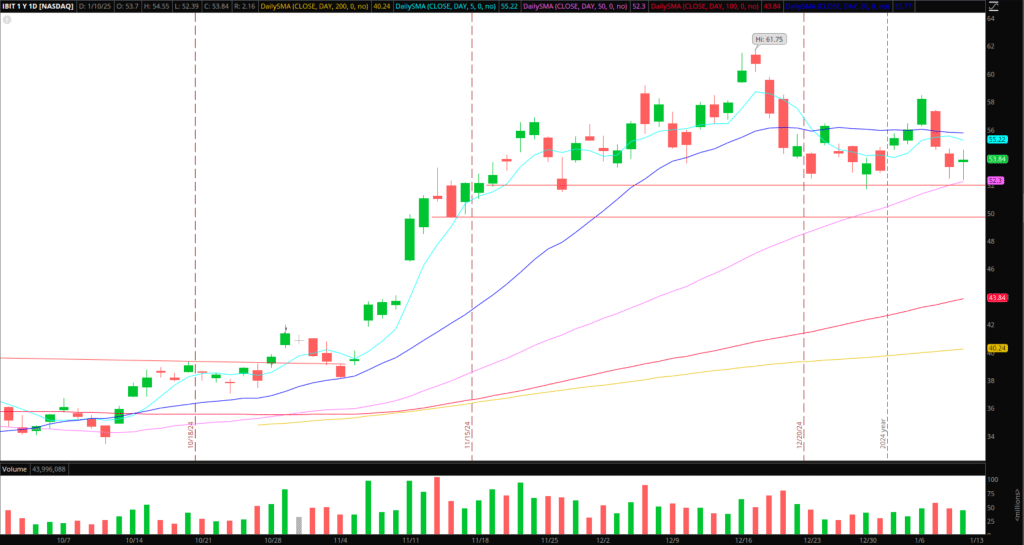

Bitcoin (IBIT) Brief By means of Vital Assist: Earlier than I’m going over names which might be exhibiting relative energy, one space of focus for the upcoming week is a brief in IBIT if Bitcoin breaks the all-important $92k space of assist. A head and shoulders sample has emerged, with $92k the essential assist zone. If Bitcoin breaks under $92k throughout common buying and selling hours, I’ll search for a reactive, momentum commerce in IBIT, concentrating on a transfer close to $50 and $88 – $87k in Bitcoin.

*Please notice that the costs and different statistics on this web page are hypothetical, and don’t mirror the influence, if any, of sure market elements reminiscent of liquidity, slippage and commissions.

Now, let’s take a look at some names displaying relative energy.

(NYSE: ONON) has bucked the market’s pattern recently and displayed rel—energy to its sector. Going ahead, I’ll look ahead to that pattern to proceed and for the inventory to base above its 20-day SMA. If it efficiently holds above the 20-day / reclaims after a pullback, I’ll enter lengthy on a push above $57 with a cease on the LOD, concentrating on a transfer between 1 ATR and the 52-week highs.

*Please notice that the costs and different statistics on this web page are hypothetical, and don’t mirror the influence, if any, of sure market elements reminiscent of liquidity, slippage and commissions.

(NYSE: ANF) One other retailer bucking the pattern. It’s not my favourite sector to commerce, however given the technical positioning of the inventory, it’s price a more in-depth look. From the weekly to the each day, a bullish consolidation aligns on a number of timeframes. It’s been in consolidation mode for nearly 5 months, with $150 vital assist and $164 vital resistance. I’m not shopping for it on this consolidation. As a substitute, I’ll have alerts set and search for a maintain above $164 on RVOL.

*Please notice that the costs and different statistics on this web page are hypothetical, and don’t mirror the influence, if any, of sure market elements reminiscent of liquidity, slippage and commissions.

(NASDAQ: SMTC) Shifting over to the semiconductor sector, which had a serious failed breakout final week, one small to midcap identify that held up effectively and displayed spectacular energy is SMTC. For that purpose, it’s on my watchlist for the upcoming week, the place I’ll preserve tabs on the identify and search for additional construct and relative energy. If the inventory continues to kind after which takes out final week’s excessive, that would be the set off for me to enter lengthy with a LOD cease. Initially, I’ll look to focus on a 1 ATR upmove, the place I’ll cowl half and path the remainder of the place.

*Please notice that the costs and different statistics on this web page are hypothetical, and don’t mirror the influence, if any, of sure market elements reminiscent of liquidity, slippage and commissions.

(NASDAQ: NBIS) Software program and AI infrastructure play that has additionally bucked the pattern and closed the week out simply shy of 9%. For the reason that inventory restarted buying and selling in October, a gradual pattern has shaped, the place most not too long ago, I appreciated the construct over $26, with earlier resistance turning into assist. The next low is now established above the growing 20-day and rising 5-day SMA. So, going ahead, I received’t look to chase highs. As a substitute, I’m searching for continued outperformance and, ideally, one other few days to every week of consolidation and vary contraction above $30 – $32 for a greater R: R breakout over $34.

*Please notice that the costs and different statistics on this web page are hypothetical, and don’t mirror the influence, if any, of sure market elements reminiscent of liquidity, slippage and commissions.

Lastly, one thing to look at for the upcoming week is whether or not various vitality names, reminiscent of CEG, VST, GEV, and TLN, will proceed outperforming. I’m not seeking to chase 52-week highs right here; I’m simply maintaining tabs to see if this additional builds momentum.

Extra Backburner Concepts:

RGTI / IONQ: I’m not attempting to choose a backside. I might solely go lengthy if a spot down capitulates, which has not but occurred. Alternatively, I’m most inquisitive about a multi-day grind / bounce greater, presenting one other alternative to quick.

DATS: On look ahead to pops to quick versus the HOD so long as it fails to construct above multi-day VWAP and stays below Friday’s excessive. Move2move buying and selling solely.

SILO: On look ahead to a possible liquidity entice just like SPI’s transfer from Friday. Move2move buying and selling solely.

Get the SMB Swing Buying and selling Analysis Template Right here!

Vital Disclosures