Let me be extra particular on what ratio unfold I’m speaking about.

As a result of there are numerous varieties of ratio spreads.

Contents

We are going to use the next ratio unfold on Salesforce (CRM) for example.

Date: Jul 1, 2024

Value: CRM @ $256.45

Promote two contracts Aug 9 CRM $240 put @ $2.40Buy one contract Aug 9 CRM $245 put @ $3.43

Internet credit score: $136

We’re utilizing all put choices.

These choices are all out-of-the-money to start with.

That signifies that the strike costs are beneath the inventory’s present value.

It is very important word that this ratio unfold receives a credit score at the beginning of the commerce.

Relying on what strike value is chosen, it’s doable {that a} ratio unfold of this kind could require a debit.

Right this moment, we’re solely trying on the ones that obtain a credit score, as they behave considerably just like a credit score unfold.

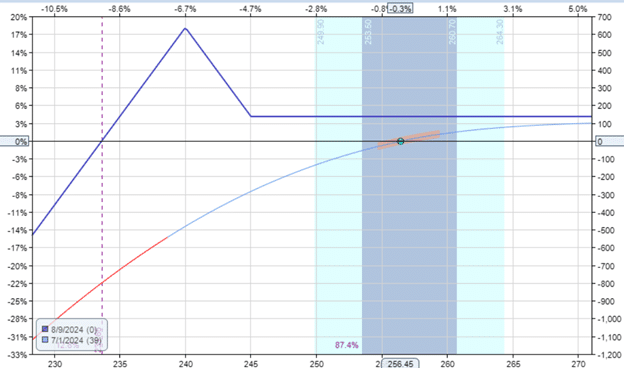

The underside horizontal axis of this payoff diagram exhibits the CRM value.

It’s presently at $256.45

The fitting vertical axis exhibits the revenue and lack of the inventory (P&L).

The stable blue line signifies the P&L at expiration on Aug 9, which is 39 days from when the commerce is initiated.

This line is named the expiration line.

The curved line represents the P&L on the present time.

There are 4 potentialities at possibility expiration.

The inventory value of CRM is bigger than $245

The inventory value of CRM is between $240 and $245

The inventory value of CRM is between $240 and $233.64

The inventory value of CRM is beneath $233.64

The costs of $240 and $245 are the strike costs of the ratio unfold.

That is additionally the place the stable blue expiration graph pivots and adjustments course.

If CRM is bigger than $245, then all the put choices stay out-of-the-money.

If put choices are out-of-the-money at expiration, they change into nugatory.

No cash adjustments arms.

No project of choices.

Nothing occurs.

The choices disappear.

The investor retains the preliminary $136 they acquired at the beginning of the commerce.

You’ll be able to see from the expiration graph that the commerce’s revenue is $136 if CRM is above $245 at expiration.

Free Wheel Technique eBook

If CRM is between $240 and $245 at expiration, the value is inside the debit unfold of the ratio unfold.

What do I imply?

You’ll be able to consider the ratio unfold as a put debit mixed with a brief put possibility.

Put Debit Unfold:

Promote one contract Aug 9 CRM $240 put @ $2.40Buy one contract Aug 9 CRM $245 put @ $3.43

Brief Put:

Promote one contract Aug 9 CRM $240 put @ $2.40

Contemplating the brief put possibility, CRM is above the brief strike of $240.

Subsequently, the brief put is out-of-the-money and expires nugatory.

Contemplating the put debit unfold, CRM is above the brief put possibility strike value of $240.

Subsequently, this second brief put additionally expires nugatory.

CRM market value is beneath the lengthy put possibility with a strike of $245.

The put possibility holder has the precise to promote CRM at $245.

If the investor had 100 shares of CRM, that may be what the investor would do since it’s of economic profit for the investor to take action.

Many brokers will routinely do that for the investor at expiration.

Nevertheless, if the investor didn’t have 100 shares of CRM to promote, the investor would see money coming into the account as a substitute.

It will be as if the dealer bought 100 shares of CRM on the present market value after which offered it at $245.

Relying on how far the market value is beneath the strike value, that money might be as little as a penny or as a lot as $500.

The max revenue of the debit unfold is $500 as a result of if one had been to purchase at $240 and promote at $245.

That is along with the preliminary credit score of $136 at the beginning of the commerce.

So max revenue on the ratio unfold is $136 + 500 = $636.

And that is what you see within the revenue graph.

It peaks at $636 when the value of CRM is at $240 at expiration.

A simple technique to keep in mind is that the max revenue of a ratio unfold of this kind is the credit score acquired plus the width of the strikes.

Keep in mind to multiply the width of the strikes by 100, although.

The 2 brief places have strikes at $240. We are saying that the brief strikes are at $240.

If CRM is beneath the brief strikes, does the investor get assigned the inventory?

Sure, they do.

However solely on one of many brief places.

Once more, we should break the ratio unfold right into a debit unfold and a brief put.

Put Debit Unfold:

Promote one contract Aug 9 CRM $240 put @ $2.40Buy one contract Aug 9 CRM $245 put @ $3.43

Brief Put:

Promote one contract Aug 9 CRM $240 put @ $2.40

With CRM beneath $240, the debit unfold is at a most revenue, and the investor good points $500 money from it.

The investor is assigned 100 shares of inventory at $240 per share on that second brief put possibility.

At expiration, there isn’t any extra ratio unfold, and the investor is left holding 100 shares of CRM inventory.

Did the investor revenue general or not?

That relies on how far beneath $240 the value of CRM was at expiration.

The web money acquired is $636 because of the preliminary credit score of $136 plus $500 from the debit unfold.

Meaning CRM can go beneath the strike value by $6.36 and stay worthwhile.

So $240 – $6.36 = $233.64.

That’s the breakeven value.

You’ll be able to affirm within the above graph that that is the CRM value the place the expiration P&L crosses the zero revenue horizontal.

If CRM is between $240 and $233.64, the commerce is worthwhile although 100 shares of inventory are assigned.

If CRM is beneath $233.64, the commerce is at a loss with 100 shares of inventory assigned.

Just a few different factors of word for this put credit score ratio unfold.

It’s doable for such a ramification to be initiated for a credit score and to be closed for an additional credit score.

Simply because the commerce construction has two brief put choices doesn’t imply you’ll get assigned 200 shares of shares.

At most, you may solely be assigned 100 shares.

Subsequently, an investor must have money obtainable to buy 100 shares if the investor plans to carry the commerce to expiration.

Some traders could wish to maintain to expiration with the plan to transition to the choice wheel technique when shares are assigned.

We hope you loved this text on what occurs in an choices ratio unfold at expiration.

In case you have any questions, please ship an e mail or go away a remark beneath.

Commerce protected!

Disclaimer: The knowledge above is for academic functions solely and shouldn’t be handled as funding recommendation. The technique offered wouldn’t be appropriate for traders who are usually not acquainted with change traded choices. Any readers on this technique ought to do their very own analysis and search recommendation from a licensed monetary adviser.