The IVOL ETF is the Quadratic Curiosity Fee Volatility and Inflation Hedge.

That’s a mouthful.

Nancy Davis based Quadratic Capital Administration in 2013 after working at Goldman Sachs and Highbridge Capital Administration.

Contents

Quadratic Capital Administration’s flagship product, IVOL, is a hedge in opposition to rate of interest and inflation threat utilizing mixtures of fixed-income securities and choices merchandise.

IVOL invests in Treasury Inflation-Protected Securities (TIPS), designed to guard in opposition to inflation, as their principal worth adjusts primarily based on modifications within the Client Worth Index (CPI).

IVOL goals to revenue from the rotation of the U.S. Treasury yield curve.

The yield curve plots the short-term charges in relation to the longer-term charges.

The yield is on the y-axis.

The Treasury phrases are on the x-axis, with a one-month time period on the left and a 30-year time period on the best.

IVOL income when this graph rotates counter-clockwise.

That is known as the steepening of the yield curve. This will happen both as a result of short-term charges are falling, or as a result of long-term charges are rising, or each.

Due to the distinctiveness of this ETF, it has low correlations with different main belongings.

Subsequently, supplementing this ETF to a portfolio offers diversification, which reduces the portfolio’s general threat.

The ETF reality sheet exhibits IVOL’s every day correlation to the S&P 500 is 0.04.

The correlation to DOW is 0.03.

The correlation to gold is 0.21.

The correlation to the VIX is 0.03.

The correlation of the Mixture Bond Index is 0.40.

A correlation of 0 means no correlation. A correlation of 1 means extremely correlated.

Each of the agency’s ETF merchandise have “quadratic” as the primary phrase of their names:

Quadratic Curiosity Fee Volatility and Inflation Hedge (IVOL)

and

Quadratic Deflation (BNDD)

What’s the significance of the phrase quadratic?

A clue might be present in an interview with Nancy Davis on Fox Enterprise.

She used the phrase “quadratic” to explain the uneven reward-to-risk traits of sure choices and by-product merchandise.

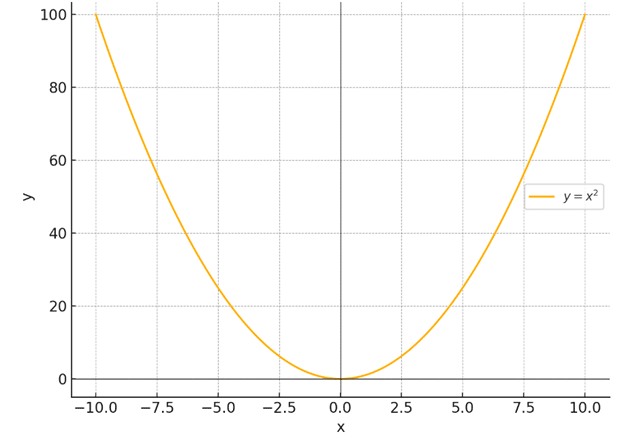

Do you keep in mind drawing out a quadratic equation on graph paper in algebra class whenever you have been younger?

Okay, possibly not.

You had a scientific calculator to try this for you.

This can be a graph of a quadratic equation y = x^2.

Free Wheel Technique eBook

If the y-axis is the potential revenue reward, what choices construction may have a reward curve that’s much like this?

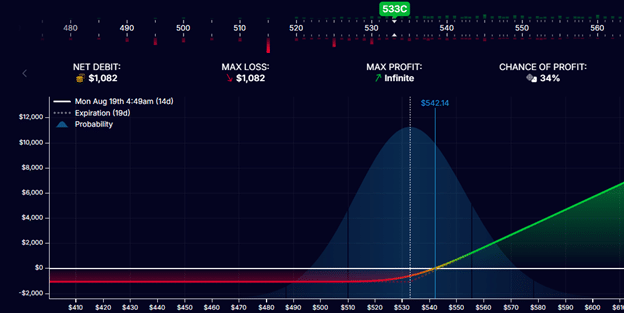

Right here is the revenue graph of an extended name:

The max loss is the premium paid for the choice, however its reward is theoretically limitless.

OptionStrat says that its “max revenue” is “infinite.”

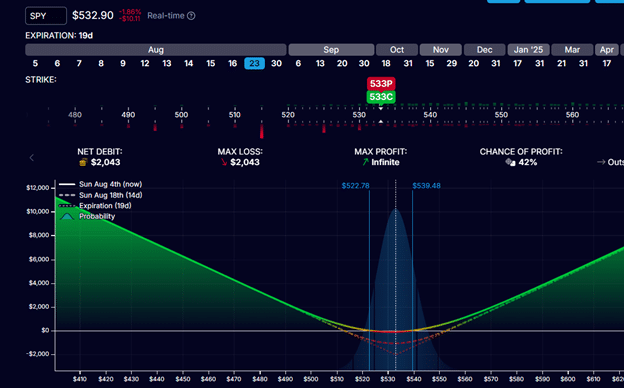

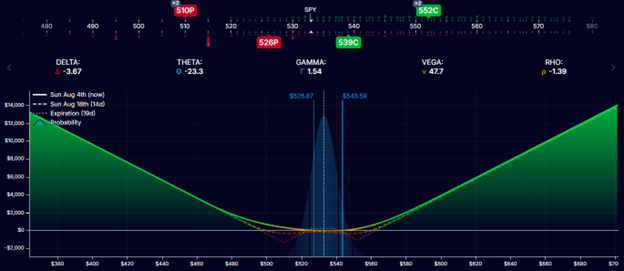

Under is the reward curve of an extended straddle on SPY:

Infinite reward in both course as SPY goes up or goes down.

The graph is wanting extra “quadratic”.

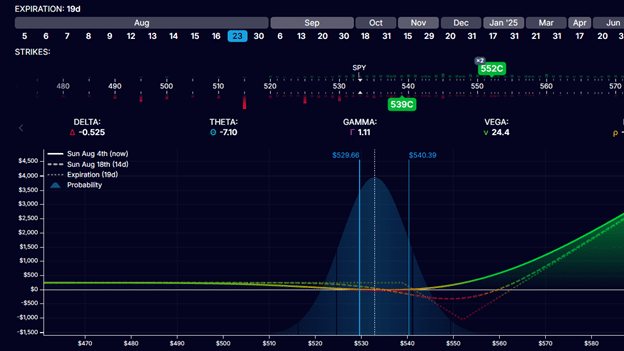

The subsequent one is a graph of a name ratio unfold the place you promote one name choice and purchase two name choices.

Here’s a name ratio unfold with a put ratio unfold:

All these curves are constructed by being web lengthy choices.

When one has lengthy choices (or lengthy premiums), one could make greater than what one is risking.

Essentially the most you may lose is the web premium paid, however the rewards might be rather more than the danger.

These examples are meant solely to explain the phrase quadratic and don’t point out how the IVOL ETF works beneath the hood.

To take action, it’s important to look inside its reality sheet, which might be discovered on ivoletf.com.

Nancy Davis’ distinctive model of derivatives-based macro investing led to the creation of the IVOL fund, which received the “Greatest New U.S. Fastened Earnings ETF for 2019” award from ETF.com within the 12 months of its launch.

We hope you loved this text in regards to the IVOL ETF.

When you have any questions, please ship an e-mail or go away a remark under.

Commerce secure!

Disclaimer: The knowledge above is for instructional functions solely and shouldn’t be handled as funding recommendation. The technique offered wouldn’t be appropriate for traders who are usually not acquainted with trade traded choices. Any readers on this technique ought to do their very own analysis and search recommendation from a licensed monetary adviser.