How To Profitably Commerce Bitcoin’s In a single day Periods?

As curiosity in cryptocurrencies continues to surge, pushed by every new value rally, crypto property have solidified their place as one of many important asset courses in world markets. Not like conventional property, which primarily commerce throughout normal working hours, cryptocurrencies commerce 24/7, presenting a novel panorama of liquidity and volatility. This steady buying and selling surroundings has prompted us to research how Bitcoin, the flagship cryptocurrency, behaves throughout intraday and in a single day durations. With Bitcoin’s rising availability to each retail and institutional buyers via ETFs and different funding autos, we hypothesized that buying and selling exercise in these distinct timeframes may reveal patterns just like these seen in conventional markets, the place returns are sometimes impacted by liquidity shifts throughout off-peak hours.

We now have been overlaying the ideas and matters regarding crypto extensively. For extra comparable articles, verify our cryptocurrency buying and selling analysis subpage or search for the articles with the “cryptocurrencies” tag on our weblog. Alternatively, you’ll be able to go to our intensive library of cryptocurrency buying and selling methods.

This examine’s major objective is

to investigate the day by day versus the in a single day (nightly) buying and selling classes within the crypto(currencies) house

examine whether or not the general in a single day impact exists within the major uncrowned flagship assetl Bitcoin (BTC), and in that case, to what extent

analyze, whether or not the “day of the week” or “weekend” impact exists in cryptocurrencies (Bitcoin)

use the entire above to construct a seasonal technique that may exploit the seasonal impact within the BTC market

Background

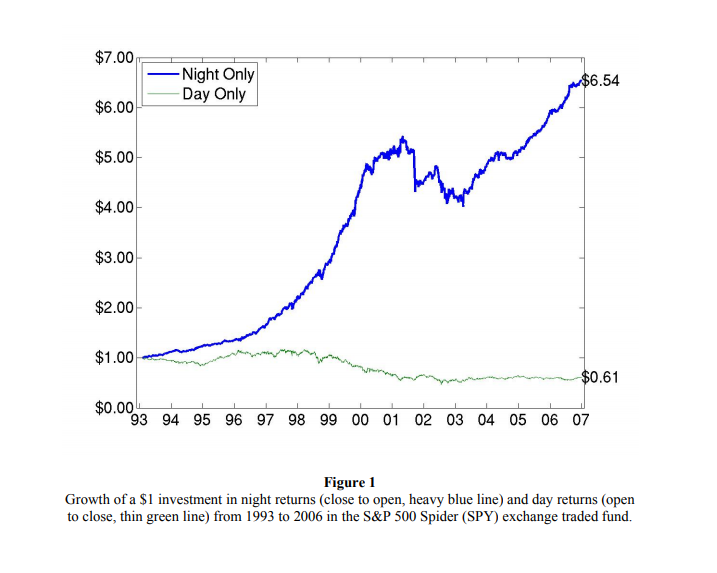

Referencing the graph from our prior analysis on the Lunch Impact within the S&P 500 and different main U.S. inventory indices, we noticed that almost all SPY and inventory index efficiency accrues largely through the nightly classes:

And for placing issues into perspective, here’s a shorter pattern from the analysis paper revealed in 2008 (as we will see, not so much has modified over the past 16 years):

In a single day Anomaly as introduced by Cliff, Cooper, Gulen: Return Variations between Buying and selling and Non-Buying and selling Hours: Like Night time and Day.

Our goal and purpose, subsequently, is to grasp the affect of day by day and nightly classes on Bitcoin efficiency, notably in gentle of the introduction of Bitcoin ETFs. This means there could be a shift from 24/7 buying and selling to a extra structured buying and selling surroundings akin to these on conventional exchanges (such because the NYSE, NASDAQ, AMEX, ARCA, and so forth).

Motivation

We suspect that since inflows and outflows from ETFs buying and selling on these TradFi domains are extremely tied to exchanges’ open hours, it should turn out to be extra prevalent that Bitcoin buying and selling modifications are increasingly more tied to these of conventional property akin to equities and bonds.

Institutional merchants normally unload or provoke (take) positions primarily on the open(ing) and shut of the primary session, the place they’ve sufficient liquidity to fulfill their orders (not accounting for block trades in darkish swimming pools or TWAP orders through the day); therefore, the primary and final buying and selling moments by way of time-span of minutes in day by day buying and selling classes are erratic and unstable (which day-traders attempt for; unusual buyers not a lot so). Add market makers’ pursuits in thoughts, which can be some over-standing stock on their books they should liquidate, in addition to choices sellers hedging their flows. You get the proper time for conflicting pursuits that incessantly help the value discovery and transfer the value towards the market’s consensus view, normally forming the development in traded property for the remainder of the day.

These items had been unknown primarily to Bitcoin, because it was traded in lots of decentralized venues (spot or futures), which allowed solely instantaneous value arbitrage amongst them if liquidity constraints had been in favorable circumstances.

Bitcoin is traded nonstop and sometimes may be the primary, riskiest asset readily liquidated in anticipation of upcoming volatility, akin to (geo)political tensions or different unspecified excessive and non-predictable occasions when conventional finance exchanges are closed. Now that Bitcoin has obtained Wall Road’s blessing and approval and is accepted as a respectable asset class by ETFs, the SEC can also be changing into slightly bit much less strict in regulation by taking small steps akin to approving choices buying and selling on stated ETFs, BeInCrypto knowledgeable in late October. So, have Bitcoin’s distinctive traits relating to classes’ distribution of returns turn out to be distorted, shifted, reversed, and at the moment are extra resembling time-tested property like ETFs and shares?

Knowledge

Our evaluation is predicated on the hourly BTC knowledge from the Gemini Knowledge web page in intervals starting from 2015-10-08 to 2024-10-15. We outline the day by day session as efficiency between 10 am EST and 4 pm EST throughout buying and selling days when the NYSE trade is opened. All the hours out of this interval are outlined as in a single day classes. It’s the identical knowledge supply we utilized in our earlier article by which we revisited trend-following and mean-reversion methods in Bitcoin.

We assume that the underlying futures of ETF BITO can precisely monitor and predict the affect of cryptocurrencies’ “institutionalization” precisely from its Inception Date on 2021-10-18. Subsequently, for simplicity, we cut up our pattern into an in-sample interval (till October 2021, throughout which the easy ETF buying and selling automobile was not out there for BTC buying and selling) and an out-of-sample interval (after October 2021).

We perceive that our definition of in-sample and out-of-sample durations may be very arbitrary. It’s not potential to outline the precise time when Bitcoin (and different cryptocurrencies) turned a conventional asset and was now not thought-about an unique funding. The road between conventional property and various property is a blurry one. What we wish to present is that there’s/was a shift in Bitcoin’s conduct in in a single day and intraday classes over time.

Preliminary Investigations

After gathering all of the wanted knowledge, we began processing it and growing our preliminary investigation.

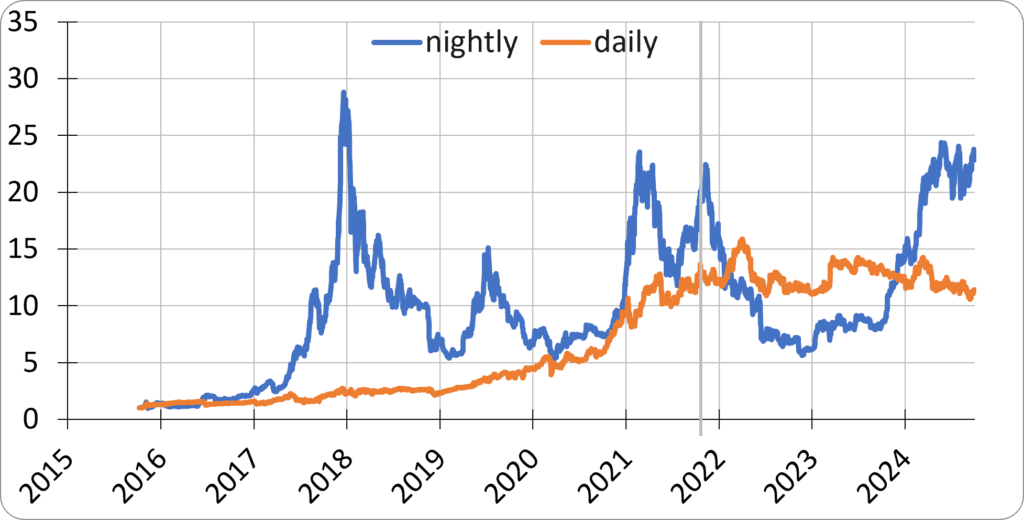

The next graph evaluation illustrates returns throughout day by day vs. nightly buying and selling classes over time:

We highlighted milestones of our curiosity and marked the launch of the primary BTC ETF (2021-10-18) throughout the graph with a thick gray line.

As an summary, we put two factors of essential observations:

A good portion of sturdy BTC actions (each up-trends and downtrends) are inclined to happen within the nightly classes.

The day by day classes carried out nicely till 2021 however have plateaued over the past three years.

The speculation in regards to the “In a single day Impact” posits that almost all efficiency in dangerous property akin to equities is realized throughout nightly (so from near open; “nocturnal”) buying and selling classes as compensation for the related dangers. That may be a time whenever you can’t normally commerce so much, so whenever you maintain an asset in a single day, you’re compensated for its illiquidity (or decrease liquidity) with larger efficiency. As Bitcoin more and more integrates into conventional monetary techniques, this precept can also be anticipated to use to BTC.

Our constructed close-to-open versus open-to-close efficiency graph above confirms the beforehand outlined theoretical assumptions. Initially (till round 2021), the efficiency of the BTC throughout day by day classes was considerably constructive, and BTC holders may multiply their property with a low threat (volatility and drawdowns). The nightly classes supplied larger efficiency but in addition larger threat (volatility and drawdowns). As Bitcoin step by step turned an asset class just like different important asset courses, returns over the day by day classes diminished, and many of the BTC returns since 2021 had been realized through the nightly classes. That is exactly the identical sample as in shares or fairness indexes!

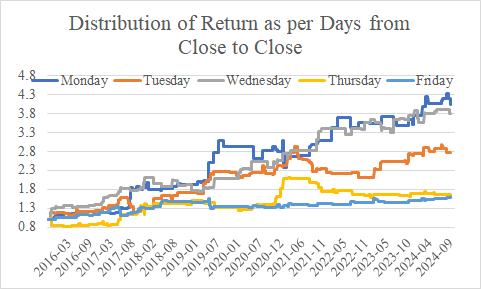

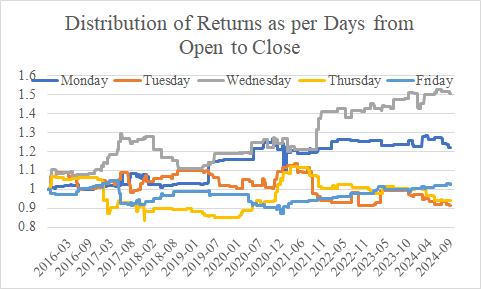

Deconstructing the Composition of Bitcoin Returns for Every Day

Let’s transfer on and decompose Bitcoin’s efficiency by particular person buying and selling days (Monday, Tuesday, and so forth.), analyzing close-to-open, open-to-close, and close-to-close classes. Based on our definition, Monday night time’s efficiency contains the interval from Friday near Monday morning (the entire weekend with conventional finance, whether or not securities or foreign exchange, exchanges are closed). Tuesday night time’s efficiency contains the interval from Monday’s shut (4 pm EST) till Tuesday’s open (10 am EST), and so forth.

The outcomes are displayed in tabular and graphical codecs, with a conclusion indicating that the first (most contributing) efficiency happens on Monday, Tuesday, and Wednesday close-to-close classes. Nonetheless, this efficiency is pushed primarily by the nightly classes. So Bitcoin strikes to the constructive territory primarily between Friday’s shut and Monday’s open (so over the weekend), between Monday’s shut and Tuesday’s open, and between Tuesday’s shut and Wednesday’s open. As we transfer nearer to Friday, Bitcoin’s efficiency diminishes (in intraday and in a single day classes, too). Plainly, finally, there actually exists a “Weekend Impact” in Bitcoin returns—a big affect of Saturdays and Sundays when conventional monetary exchanges (like NYSE) are closed.

OK, we all know that BTC is delicate to the in a single day/intraday cut up and it’s delicate to the Weekend Impact. Now, the query is, what can we do about it? Our subsequent sections intention to discover a strategy to revenue from this discovering.

Replication of the Earlier Analysis Methodology

Firstly, we took our older trend-following examine and replicated the MAX technique with 5-day, 10-day, and 50-day excessive parameters.

Our trend-following and mean-reversion examine was backtested on day by day bars with 0.00 GMT time stamps and utilizing a 24/7 buying and selling calendar (trades may be executed on Saturdays, Sundays, and likewise throughout public holidays). Subsequently, our first step was to verify how the trend-following technique that buys new native highs (5, 10, 20, 30, 40, or 50-days) performs if we restrict our buying and selling choices and may commerce solely on the ETF market shut at 4 pm on days when the NYSE is open. We used Gemini knowledge and the NYSE calendar to create such knowledge collection and examined our MAX technique on it. This straightforward technique (purchase a Bitcoin within the type of cryptocurrency, futures contract, CFD, or ETF at NYSE shut, when Bitcoin is on the native X-day excessive, maintain for one buying and selling day) may be simply executed with ETFs from 2021 onwards. Nonetheless, we’re not utilizing the precise ETF closing costs however Gemini BTC knowledge. This permits us to check the technique’s efficiency even earlier than any Bitcoin ETFs had been launched.

And right here we’ve got a complete graph showcasing all variations in combination for the buying and selling interval from close-to-close, together with detailed tables:

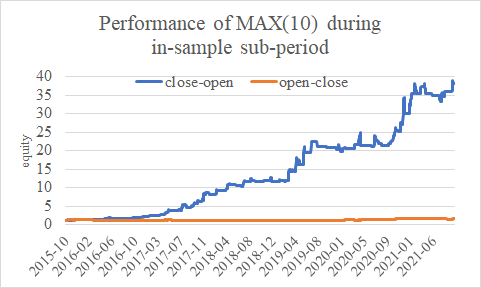

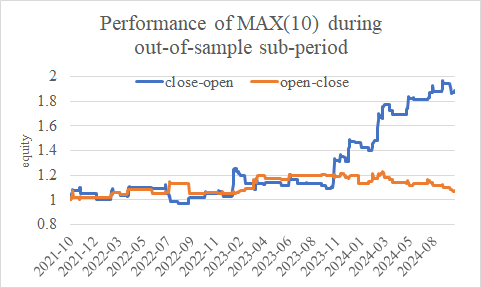

For consistency with our prior publications, we finally moved ahead and used a 10-day model regardless of it not being optimum with the very best returns. This model, for functions of this analysis publication, requires the presentation of close-to-open and open-to-close efficiency graphs, tables, and an applicable abstract as beforehand described:

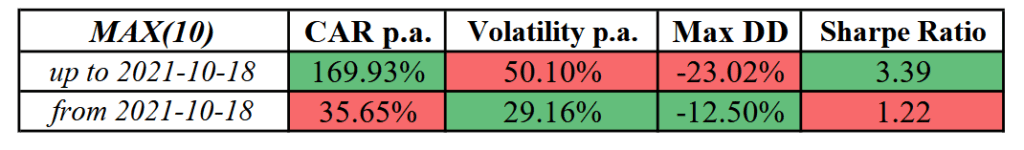

As we will see, Bitcoin MAX technique carried out higher through the first sub-period earlier than the primary ETF introduction. Within the out-of-sample interval, the technique nonetheless has over 35% efficiency with a minimal -12% maximal drawdown (and considerably outperforms the underlying Bitcoin market on a risk-adjusted foundation), however as Bitcoin has turn out to be a typically accepted, mainstream asset class, the easy trend-following technique that buys new native highs doesn’t provide the identical juice as earlier than. What can we do about it? Let’s focus our consideration on the in a single day anomaly and filter our trades slightly. It’s the identical trick we used once we had been investigating the in a single day reversal within the high-yield market.

MAX(10) Technique Efficiency Throughout Sub-Intervals

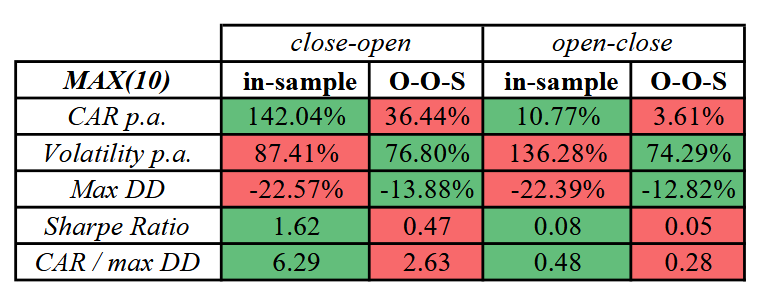

Firstly, we will attempt to examine the 10-day MAX technique in close-to-open and open-to-close sub-periods (only a quick reminder that in-sample is till October 2021, and out-of-sample [OOS] is from October 2021 onwards):

This part demonstrates that almost all returns of the MAX(10) technique all through historical past, each in-sample and out-of-sample, are generated through the in a single day buying and selling session (from near open).

Last Buying and selling Technique Proposal

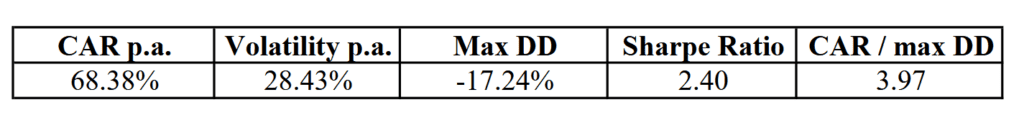

OK, we’re close to the tip of our evaluation. We realized that Bitcoin is delicate to intraday vs. in a single day cut up, to the day-of-the-week (or Weekend) impact, plus it tendencies so much (as soon as, when it’s on the native excessive, then it normally continues in constructive development and finally to the upper value). Subsequently, we suggest a consolidated MAX(10) technique, which operates completely throughout night time classes spanning Friday to Monday night time, Monday to Tuesday night time, or Tuesday to Wednesday night time. This closing technique is illustrated with a single fairness curve, efficiency desk, and an evaluation of the technique’s efficiency each in-sample (as much as 2021) and out-of-sample:

We now have a wonderful instance of the mixture of weekend and in a single day results, as you’ll be able to go lengthy on Friday’s shut if you’re on a neighborhood 10-day MAX, maintain the BTC till Monday morning (open), and go lengthy once more on Monday’s and/or Tuesday’s shut if the Bitcoin continues to be on the native 10-day MAX. The technique affords a sexy Sharpe ratio and low threat and reveals that Bitcoin continues to be a younger asset, burdened by inefficiencies rather more than conventional, mature basic asset courses and their constituents.

In gentle of our evaluation, the easy technique centered on nightly buying and selling classes has yielded substantial insights into Bitcoin’s efficiency dynamics. The technique, working completely throughout night time classes from Friday to Monday, Monday to Tuesday, and Tuesday to Wednesday, has demonstrated that a good portion of Bitcoin’s returns is realized in a single day. This sample is in line with conventional asset courses, the place the In a single day threat premium is acknowledged, suggesting that as Bitcoin integrates extra into typical monetary markets, its return distribution mirrors that of established property.

The findings from this technique point out that Bitcoin, regardless of its distinctive traits and the 24/7 buying and selling surroundings, behaves equally to different monetary devices when topic to institutional buying and selling patterns. This implies a gradual alignment with conventional market behaviors, doubtlessly pushed by the growing participation of institutional buyers and the introduction of Bitcoin ETFs. These outcomes spotlight the significance of contemplating buying and selling session dynamics when growing buying and selling methods and threat administration frameworks for Bitcoin and different cryptocurrencies.

In conclusion, our examine reinforces that the in a single day impact considerably drives Bitcoin’s efficiency. The technique’s success underscores the worth of specializing in particular buying and selling classes to optimize returns and handle dangers successfully. As Bitcoin continues to achieve legitimacy and combine into conventional monetary techniques, ongoing analysis can be important to adapt buying and selling methods and capitalize on rising tendencies, making certain that buyers stay forward of the curve on this evolving market.

Writer: Cyril Dujava, Quant Analyst, Quantpedia

Are you searching for extra methods to examine? Join our e-newsletter or go to our Weblog or Screener.

Do you wish to be taught extra about Quantpedia Premium service? Verify how Quantpedia works, our mission and Premium pricing provide.

Do you wish to be taught extra about Quantpedia Professional service? Verify its description, watch movies, assessment reporting capabilities and go to our pricing provide.

Are you searching for historic knowledge or backtesting platforms? Verify our listing of Algo Buying and selling Reductions.

Or comply with us on:

Fb Group, Fb Web page, Twitter, Linkedin, Medium or Youtube

Share onLinkedInTwitterFacebookCheck with a pal